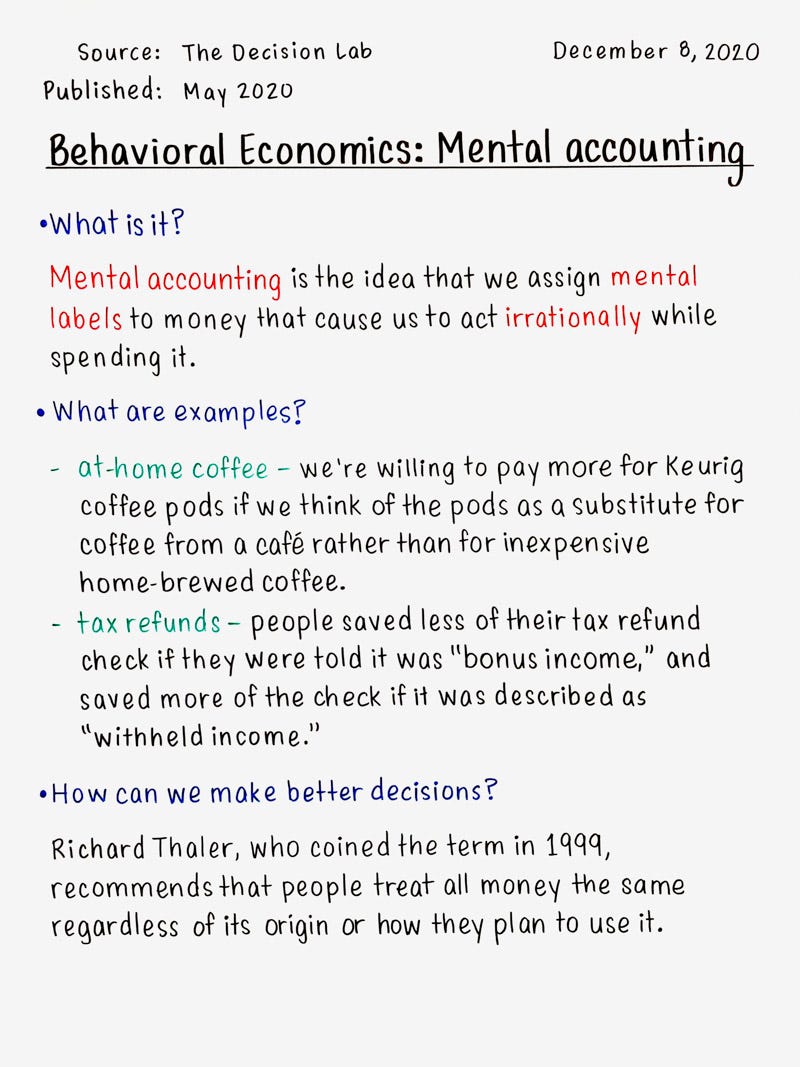

December 8: Mental accounting (Behavioral Economics)

The idea that we assign mental labels to money that in turn cause us to act irrationally while spending it.

Source: The Decision Lab

Published: May 2020

Behavioral Economics: Mental accounting

What is it?

Mental accounting is the idea that we assign mental labels to money that cause us to act irrationally while spending it.

What are examples?

at-home coffee – we're willing to pay more for Keurig coffee pods if we think of the pods as a substitute for coffee from a café rather than for inexpensive home-brewed coffee.

tax refunds – people saved less of their tax refund check if they were told it was "bonus income," and saved more of the check if it was described as "withheld income."

How can we make better decisions?

Richard Thaler, who coined the term in 1999, recommends that people treat all money the same, regardless of its origin or how they plan to use it.

------------

Did you appreciate the fact today?