September 22: An overview of Variable vs. Fixed Costs

Understanding total cost helps leaders determine the selling price of their product.

Source: Indeed

Published: February 2021

An overview of Variable vs. Fixed Costs

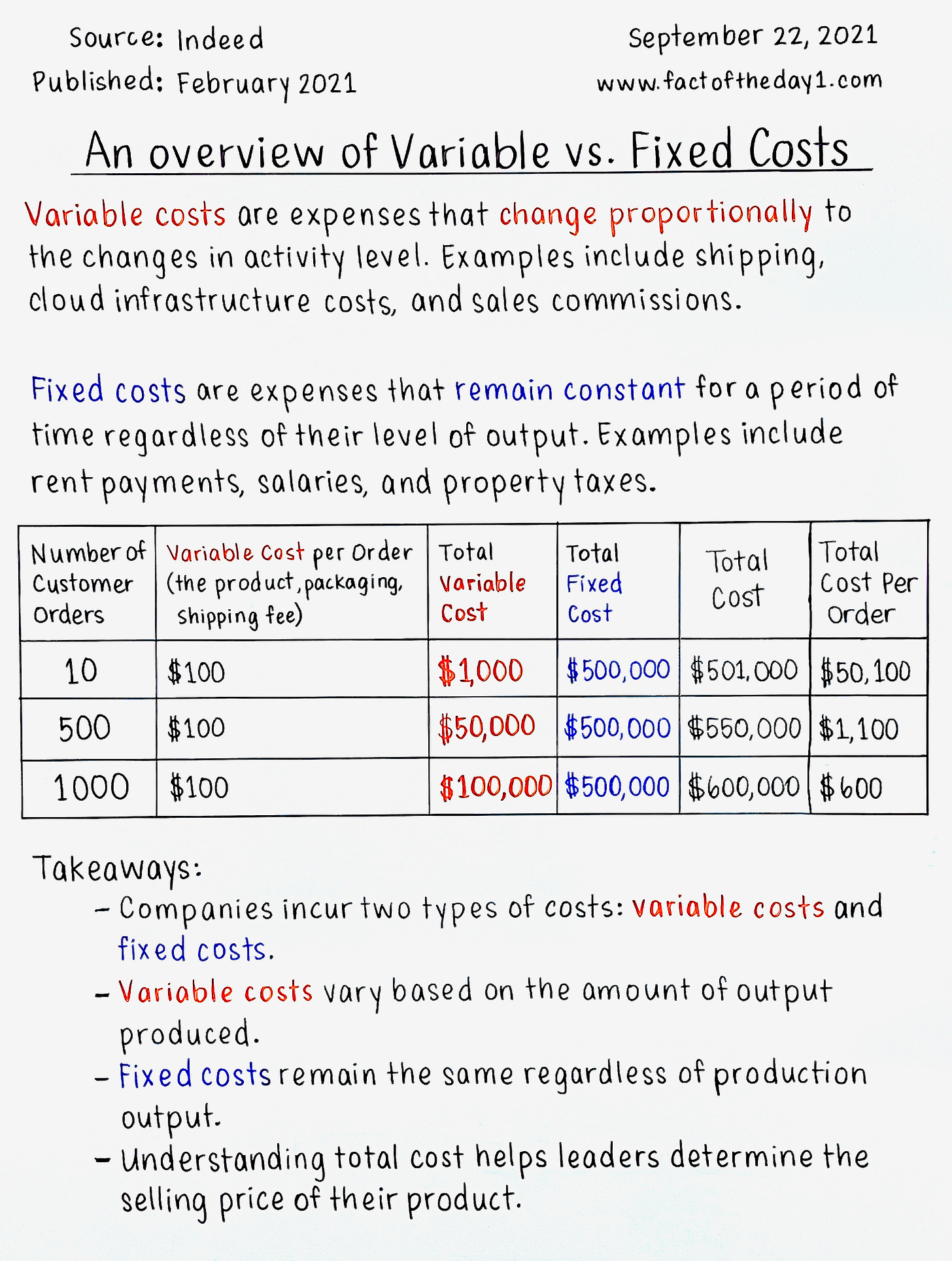

Variable costs are expenses that change proportionally to the changes in activity level. Examples include shipping, cloud infrastructure costs, and sales commissions.

Fixed costs are expenses that remain constant for a period of time regardless of their level of output. Examples include rent payments, salaries, and property taxes.

10 Customer Orders

Variable Cost per Order: $100

Total Variable Cost: $1,000

Total Fixed Cost: $500,000

Total Cost: $501,000

Total Cost Per Order: $50,100

500 Customer Orders

Variable Cost per Order: $100

Total Variable Cost: $50,000

Total Fixed Cost: $500,000

Total Cost: $550,000

Total Cost Per Order: $1,100

1000 Customer Orders

Variable Cost per Order: $100

Total Variable Cost: $100,000

Total Fixed Cost: $500,000

Total Cost: $600,000

Total Cost Per Order: $600

*Variable Cost per Order includes the product, packaging and shipping fee.

Takeaways:

Companies incur two types of costs: variable costs and fixed costs.

Variable costs vary based on the amount of output produced.

Fixed costs remain the same regardless of production output.

Understanding total cost helps leaders determine the selling price of their product.

This assumes we're talking about cost-based pricing as opposed to value-based pricing.

That could explain why buying more of the same stuff costs less.